What are Quantitative Investment Strategies?

Summary: Quantca Financial introduces a systematic and data-driven approach to investments through its quantitative investment models. By analyzing historical trends, price movements, and various financial indicators, these strategies aim to make disciplined investment decisions, minimizing the influence of human biases. In this article, Quantca introduces you to foundational concepts used in quantitative investments.

If you would like to view or download a PDF white paper version of this article, you can find it HERE.

1. Introduction

At Quantca Financial, we believe in leveling the playing field in the world of investments. That’s why we’ve developed cutting-edge quantitative investment models that are accessible to everyone. Our innovative approach combines advanced technology with data-driven analysis to provide unique opportunities for investors of all backgrounds, in ways previously not available to the general public.

“Instead of riding entire portfolios through volatile market conditions, we use complex mathematics to determine when to be in the market by calculating if the market is going up, down, or if it is likely to change direction. This creates the potential for uncorrelated returns in a variety of market conditions. Our flagship model is designed to work in both up and down markets.”

2. What are Quantitative Investment Strategies?

Quantitative investment strategies leverage advanced mathematical models and computational algorithms to analyze market data and produce investment insights. By systematically evaluating historical trends, price movements, and various financial indicators, these strategies seek to make objective and disciplined investment decisions, minimizing the influence of human biases. With quantitative investment strategies, you can back-test methodologies over decades of historical market data to help validate the viability of the strategy. This is quite different from human-based investment decision processes where the strategy can be impacted by biases and emotions, and may not be tested over extended periods of market history.

Quantitative investment strategies have been deployed by hedge funds to generate alpha with proprietary models for many years. However, this technology has historically not be accessible to the general public. Many hedge funds have developed their own proprietary platforms to deploy quantitative strategies, and there is a perspective that they are better off from a risk and return standpoint to keep the strategies in a hedge fund instead of offering it to the general public. Hedge funds only cater to millionaires by law. Quantca Financial aims to level the playing field.

3. Quantitative Investment Concept: Mean Reversion

Mean Reversion is a concept that suggests that phenomena exist in the market that may cause certain assets to have a tendency to revert to their average value over time. It implies that if an asset’s price diverges significantly from its average, it can become likely to reverse direction and return to its mean. Quantca uses the concept of mean reversion in some of it’s investment models. To demonstrate the power of this concept, we have created a reversion model to share for educational purposes only, along with 30+ years of test results on the model.

While the results are below, it is important to note that this model is for educational purposes only, and there are limits to back-test models. Read more about backtest models, including their limitations, in our firm’s brochure linked here. A back-test is essentially just identifying “had I used this methodology for this period of time, what might have happened?” Want more information? We provide a video overview including the source code of this algorithm in the members section of our website. You can create a free member account to gain access to exclusive articles, video content and concept analyses at Quantca.com/Register

This algorithm is a very simplified mean reversion implementation. It is simply looking at time, and identifying if there is a point in time after the asset is diverging from its average that it becomes probable to change direction and revert back to its average. There are a some important notes to make about this algorithm and its backtest results:

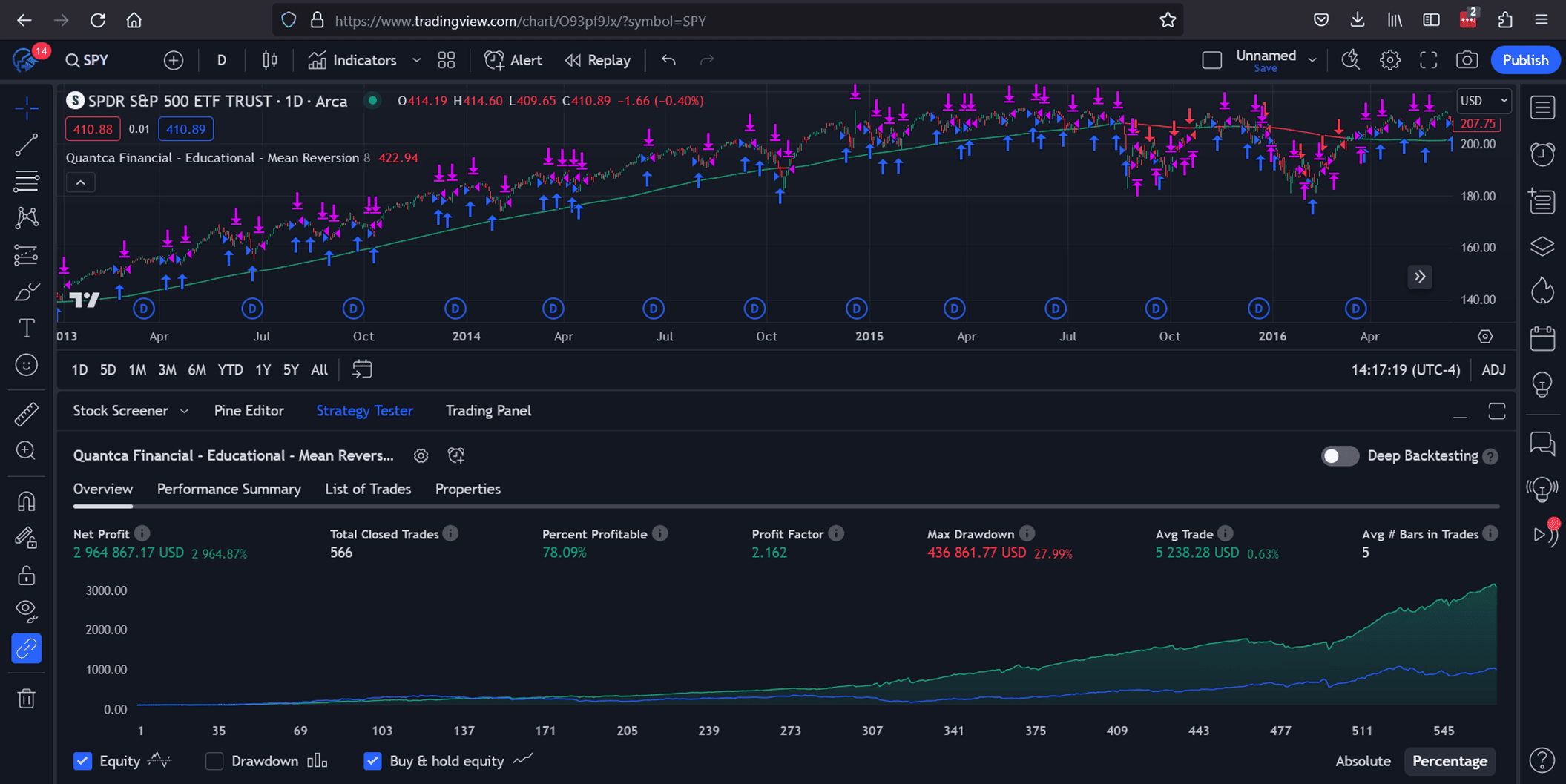

- This backtest measures a 30+ year period from February 1993 through October 2023 on an S&P500 ETF (SPY). Over this time, SPY had a buy and hold return of ~844%. This basic mean reversion model test returned ~2,964% over the same time period while also maintaining a drawdown lower than the underlying asset. You may also notice that it is essentially only trading when the market is going down.

- Quantca Financial does not trade this model or recommend you trade it. It has no risk management built into it, and we use better approaches to mean reversion for our clients. We created it for concept education purposes only. The models that Quantca Financial uses are proprietary and more sophisticated. However, this educational model still drives the point home on the power of this concept.

- We coded this algorithm in TradingView because it is a very publicly accessible platform with a built-in backtesting engine. We are not affiliated with TradingView. However, the code for this is provided in the member’s section of our website so that anyone can go in and verify this information independently.

4. Quantitative Investment Concepts: Momentum and Regressions

Time-series momentum refers to the correlation between a market’s performance and its continued performance over a specific period of time. Certain assets or bundles of assets exhibit consistent momentum behavior, while others do not. Logically one might think that conditions might exist that create probabilities for companies that are doing well to continue to do well. And, inversely, conditions might exist that create probabilities for companies that are doing poorly to continue to do poorly. Momentum is a quantitative measurement of that correlation over specific time periods. Regressions are a methodology to capitalize on momentum behaviors. A regression can be one of many formulas that calculate the trend of an underlying series of data. The example below is a simple linear regression plotted for the S&P500 SPY ETF:

We have released a concept analysis including video and source code on the topics of momentum and regressions, backtest results, and detail on how they can be used in investment strategies. For more information, create a free member account to gain access at Quantca.com/Register

5. About Quantca Financial

There are not many organizations that are willing to share the concepts they use in their investment models along with source code so that people can go in and verify this information independently. At Quantca we believe in transparency, choice and equal access to investment opportunities. We have spent thousands of hours developing quant trading models to open this technology to the general public.

We charge no up-front fees, and the client maintains liquidity and control of moving their funds directly through the broker. We offer a variety of models that span from complex equities growth strategies to compounding interest on more-stable short-term bonds. Quantca just charges a % of assets under management that varies depending on the model the client chooses.

As a Registered Investment Adviser, we can use our strategies to manage an investment account automatically on your behalf. If you would like to become a client of Quantca Financial and have one of your accounts be managed by our strategies, first go to Quantca.com/Register to register for a free member account. Client sign-up is available in the members area of the website.

6. Conclusion

Quantca Financial offers a comprehensive suite of quantitative investment strategies, backed by extensive research, market expertise, and a commitment to excellence. We invite you to join us on this journey. Take the next step and get in touch with us today to learn more about how Quantca can help.

Why Quantca?

Diversify your portfolio with our algorithm-based advisory. Instead of riding entire portfolios through extended volatile market conditions, we use complex mathematics to determine when to be in the market by calculating if the market is going up, down, or if it is likely to change direction. This creates the potential for uncorrelated returns in a variety of market conditions.

We charge no up-front fees, and the client maintains liquidity and control of moving their funds directly through the broker. We offer a variety of models that span from complex equities growth strategies to compounding interest on more-stable short-term debt. Sign up to select one of our services!