Interest Rates and the Yield Curve: Why Does it Matter?

Summary: Quantca Financial introduces a guide on the yield curve, its types, and its historical significance in predicting economic recessions. It emphasizes the yield curve’s historical reliability, noting that an inverted yield curve has preceded U.S. recessions since the 1950s. The paper sheds light on the inverse relationship between bond values and interest rates, highlighting its relevance for investment strategies, particularly for those nearing retirement.

If you would like to view or download a PDF white paper version of this article, you can find it HERE.

1. Introduction

The yield curve is a critical financial tool, representing the relationship between interest rates (or yields) of debt securities and their respective times to maturity. The curve is typically associated with U.S. Treasury securities, and their interest rate associated with government bonds with maturity dates spanning 13 weeks, 2 years, 5 years and 10 years. Analyzing the relationship between the yields over those different time horizons provides investors, economists, and policymakers with insights into current and future economic conditions, helping to inform investment strategies and policy decisions.

2. Understanding the Yield Curve

There are three primary types of yield curves, each signaling different economic conditions:

-

- Normal Yield Curve: This upward-sloping curve indicates that long-term debt instruments have a higher yield compared to short-term debt instruments. This is typically a sign of a healthy, growing economy where inflation expectations are stable, and investors require a premium for locking in their money for a longer period.

-

- Inverted Yield Curve: This curve is a situation where short-term debt instruments have a higher yield than long-term debt instruments. It is often viewed as a predictor of economic recession. It indicates that short-term bonds have a higher interest rate than longer-term bonds. This means that the market is predicting that the Federal Reserve will be lowering interest rates before the maturity of the longer-term bonds, which is something that has historically been done in periods of recession to stimulate economic growth.

-

- Flat Yield Curve: In this scenario, the yields on short-term and long-term debt instruments are very close to each other, indicating uncertainty in the markets and transitions between economic cycles.

3. The Yield Curve as a Recession Predictor

The yield curve has a history of being a reliable predictor of economic recessions. Historically, an inverted yield curve has preceded every U.S. recession since the 1950s. However, it is crucial to note that while an inverted yield curve has been a consistent indicator, it does not guarantee a recession.

The timeline between an inversion and a recession can vary, and other economic factors and indicators should be considered in conjunction with the yield curve. Global economic conditions, fiscal policies, and other macroeconomic factors also play a significant role in determining the economic outlook. With that said, here are examples of when an inverted yield preceded a financial crisis or recession:

1970s Oil Crisis and Recession:

• In the early 1970s, an oil crisis led to rising inflation and economic instability. The yield curve inverted in 1973, preceding the 1973-1975 recession.

Early 1980s Recession:

• The yield curve inverted in 1980, shortly before the U.S. experienced a severe recession from 1981 to 1982.

Dot-com Bubble and Early 2000s Recession:

• The yield curve inverted in 2000 before the bursting of the dot-com bubble and the subsequent 2001 recession.

2008 Financial Crisis (2007-2008):

• The yield curve inverted in 2006, signaling trouble in the housing market and the buildup to the global financial crisis in 2007-2008.

COVID-19 Pandemic Recession (2020):

• The yield curve inverted briefly in 2019, but it was followed by a significant inversion in March 2020 as the COVID-19 pandemic hit the global economy.

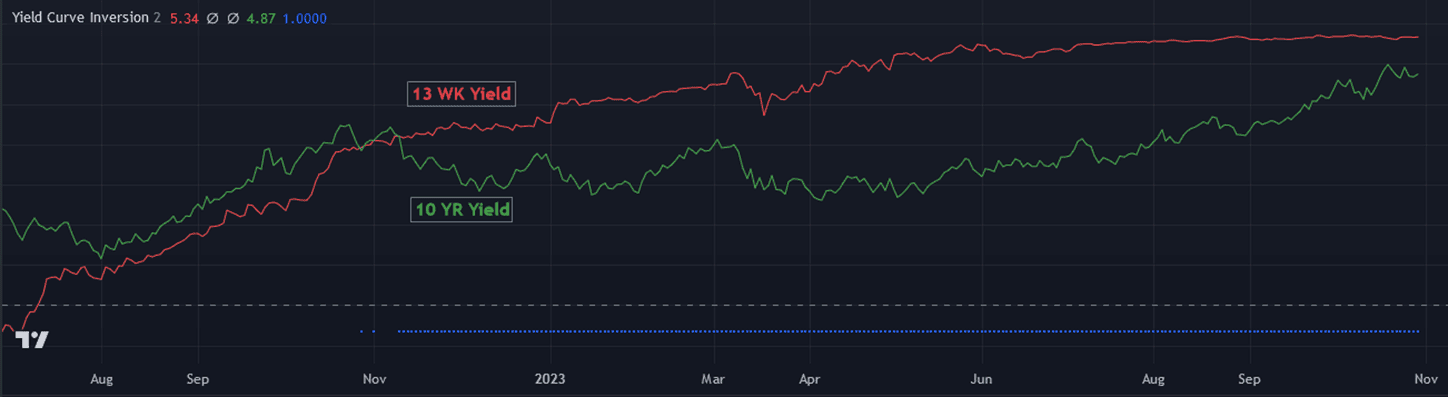

2022-2024

• The 13 week and 10 year yield curve inverted. The S&P500 had a drawdown of ~27% in 2022, and the yield curve remained inverted through most of 2024.

4. The Relationship Between Bond Values and Interest Rates

Traditional investment advisers balance portfolios with stocks and long term bonds because bonds are traditionally stable investments. The closer you are to retirement and the lower your risk tolerance is, the more likely you are to have a higher % of bonds than stocks in your portfolio.

The relationship between bond values and interest rates is inverse. When interest rates rise, the value of existing bonds falls, and vice versa. This is because new bonds issued in a higher interest rate environment will offer higher yields than existing bonds, making the existing bonds with lower interest less attractive in comparison.

For example, if you own a bond that pays 3% interest and new bonds are issued at 6%, the value of your bond will decrease significantly. This is because investors can get a better return on their investment by purchasing the new bonds. Conversely, if interest rates fall and new bonds are issued at 3%, the value of your 6% bond will increase.

Historically over the past ~30 years, the Fed has lowered interest rates to stimulate economic growth in periods of recession. This creates an environment where your bond values increase when your stocks decrease, helping to stabilize and lower the volatility of your portfolio. However, in the current environment, we are experiencing both economic decline and high inflation. This means that the Fed is likely going to continue to either raise or hold interest rates high, even with declining market conditions, in order to combat inflation.

A great example of the potential impact of this is the collapse of Silicon Valley Bank in 2023. This was the 2nd largest bank collapse in U.S. history. The bank was holding assets in traditionally safe bond holdings, but when the Federal Reserve began raising interest rates to combat inflation, the value of their bond holdings plummeted and they became insolvent.

“We have designed our models to work in environments that others haven’t anticipated yet.”

5. Why Does This Matter?

For the first time in many of our reader’s lifetimes, due to inflation and Fed policy, long-term bonds and stocks dropped in value in tandem. If your money is managed by an traditional financial or investment adviser, then you are likely already impacted by this. Did your adviser change their strategy to combat this? Ask them what they did to combat this, and you might deduce that the answer is not what you’d like to hear. However, short term bonds are not impacted by the fed rate as much as long term bonds. A strategy rolling 13 week t-bills, for instance, actually benefits from the rising interest rate environment.

6. About Quantca Financial

Quantca launched YieldSmart in order to provide a bond-investment option that is liquid, more-stable, and benefits from the high interest rate environment. At Quantca we believe in transparency, choice and equal access to investment opportunities. We have spent thousands of hours developing quant trading models to open this technology to the general public.

As an Investment Adviser, we can use our strategies to manage an investment account automatically on your behalf. If you would like to become a client of Quantca Financial and have one of your accounts be managed by our strategies, first go to Quantca.com/Register to register for a free member account. Client sign-up is available in the members area of the website.

7. Conclusion

Quantca Financial offers a comprehensive suite of quantitative investment strategies, backed by extensive research, market expertise, and a commitment to excellence. We invite you to join us on this journey. Take the next step and get in touch with us today to learn more about how Quantca can help.

Why Quantca?

Diversify your portfolio with our algorithm-based advisory. Instead of riding entire portfolios through extended volatile market conditions, we use complex mathematics to determine when to be in the market by calculating if the market is going up, down, or if it is likely to change direction. This creates the potential for uncorrelated returns in a variety of market conditions.

We charge no up-front fees, and the client maintains liquidity and control of moving their funds directly through the broker. We offer a variety of models that span from complex equities growth strategies to compounding interest on more-stable short-term debt. Sign up to select one of our services!